Do You Have To Sign Up For Medicare At 65 for Beginners

More About Medicare Supplement Plans Comparison Chart 2021 Pdf

Table of Contents8 Simple Techniques For Aarp Plan GHow Aarp Plan G can Save You Time, Stress, and Money.Medicare Supplement Plans Comparison Chart 2021 Pdf Fundamentals ExplainedThe Buzz on Shingles Vaccine CostMedicare Select Plans Fundamentals ExplainedEverything about Medicare Supplement Plans Comparison Chart 2021

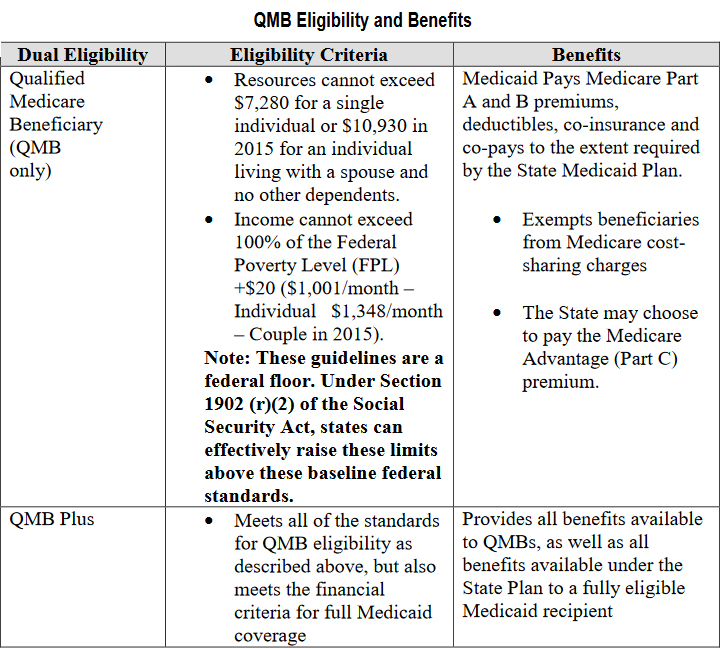

Nelson does not require to file an application for Premium-Part A because he stays in a Part A Buy-in State. (Note: If Maryland accepts Mr. Nelson's application for the QMB Program, the State will certainly enroll him in State Buy-in because he currently has Component B.

Review listed below to locate out-- If he has Medicaid or QMB, exactly how a lot will Medicaid pay?!? SHORT SOLUTION: QMB or Medicaid will certainly pay the Medicare coinsurance just in minimal scenarios.

8 Easy Facts About Shingles Vaccine Cost Shown

This produces tension in between an individual and also her physicians, drug stores dispensing Part B medicines, as well as other suppliers. Carriers might not recognize they are not permitted to bill a QMB beneficiary for Medicare coinsurance, considering that they bill various other Medicare recipients. Also those that recognize might push their patients to pay, or just decline to serve them.

The provider expenses Medicaid - also if the QMB Recipient does not also have Medicaid. Medicaid is needed to pay the supplier for all Medicare Part An as well as B cost-sharing charges for a QMB beneficiary, even if the solution is generally not covered by Medicaid (ie, chiropractic, podiatry and scientific social job care).

Cuomo has suggested to minimize just how much Medicaid spends for the Medicare prices also better (medicare supplement plans comparison chart 2021 pdf). The amount Medicaid pays is various relying on whether the person has Initial Medicare or is a Medicare Advantage plan, with better repayment for those in Medicare Benefit plans. The response additionally varies based on the kind of service.

Little Known Questions About Medicare Part G.

- - Currently, Medicaid pays the complete Medicare accepted charges till the recipient has fulfilled the annual deductible, which is $198 in 2020. For instance, Dr. John charges $500 for a visit, for which the Medicare accepted fee is $198. Medicaid pays the whole $198, satisfying the deductible. If the recipient has a spend-down, after that the Medicaid settlement would certainly go through the spend-down.

If the Medicaid rate for the same service is just $80 or much less, Medicaid would certainly pay nothing, as it would consider the medical professional completely paid = the service provider has received the complete Medicaid price, which is lower than the Medicare price. s - Medicaid/QMB wil pay the complete coinsurance for the complying with solutions, no matter the Medicaid rate: ambulance as well as psychologists - The Gov's 2019 proposal to remove these exceptions was denied.

The Facts About Apply For Medicare Uncovered

50 of the $185 approved rate, service provider will with any luck not be discouraged from offering Mary or various other QMBs/Medicaid recipients. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance since the Medicaid price ($120) is less than the amount the supplier currently received from Medicare ($148). For both Medicare Advantage as well as Original Medicare, if the costs was for a, Medicaid would certainly pay the complete 20% coinsurance despite the Medicaid price.

If the supplier desires Medicaid to pay the coinsurance, after that the provider should register as a Medicaid supplier under the state regulations. This is an adjustment in plan in implementing Section 1902(n)( 3 )(B) of the Social Safety Act (the Act), as changed by area 4714 of the Well Balanced Spending Plan Act of 1997, which bans Medicare companies from balance-billing QMBs for Medicare cost-sharing.

This area of the Act is readily available at: CMCS Educational Notice . QMBs have no lawful commitment to make more payment to a company or Medicare took care of treatment strategy for Part A or Part B cost sharing. Service providers that wrongly expense QMBs for Medicare cost-sharing undergo assents. Please keep in mind that the law referenced over supersedes CMS State Medicaid Guidebook, Phase 3, Eligibility, 3490.

Some Known Details About Medicare Part C Eligibility

CMS advised Medicare Benefit plans of the rule against Equilibrium Billing in the 2017 Phone call Letter for strategy renewals. See this excerpt of the 2017 telephone call letter by Justice in Aging - It can be challenging to reveal a service provider that is a QMB. It is particularly hard for companies that are not Medicaid companies to identify QMB's, given that they do not have access to on the internet Medicaid qualification systems If a consumer reports an equilibrium billng problem to this number, the Customer care Representative can escalate the problem to the Medicare Administrative Contractor (MAC), which will certainly send out a conformity letter to the company with a duplicate to the consumer.

50 of the $185 authorized rate, company will ideally not be prevented from serving Mary or other QMBs/Medicaid recipients. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance because the Medicaid rate ($120) is lower than the quantity the carrier currently obtained from Medicare ($148). For both Medicare Benefit as well as Original Medicare, if the bill was for a, Medicaid would certainly pay the complete 20% coinsurance no matter of the Medicaid rate.

If the carrier desires Medicaid to pay the coinsurance, then the service provider must sign up as a Medicaid carrier under the state policies. This is an adjustment in policy in executing Section 1902(n)( 3 )(B) of the Social Security Act (the Act), as modified by area 4714 of the Well Balanced Spending Plan Act of 1997, which forbids Medicare carriers from balance-billing QMBs for Medicare do i have to sign up for medicare at 65 cost-sharing.

Some Ideas on Medicare Part G You Should Know

This area of the Act is offered at: CMCS Educational Bulletin . QMBs have no lawful obligation to make additional settlement to a carrier or Medicare managed treatment strategy for Part A or Component B price sharing. Service providers who wrongly expense QMBs for Medicare cost-sharing undergo assents. Please note that the statute referenced above supersedes CMS State Medicaid Manual, Chapter 3, Eligibility, 3490.